That is they try to earn income should the banks main business suffer a decline if say interest rates rise. Those commitments give rise to new types of credit risk from the possibility of default by the counter party. During the past couple of decades financial institutions have sharply expanded their off-balance sheet activities. What are off-balance-sheet items and why are they important to some financial firms. Also known as Off-Balance sheet items Off-Balance sheet assets or liabilities and Incognito Leverage. It also affects the entire range of financial. Which are contingent in nature are some of the examples off -balance sheet exposures of the banks. The above mentioned items. SLR Tier 1 Capital Total Leverage Exposure. The non-fund based facilities like Issuance of letter of guarantee letter of credit deferred payment guarantee letter of comfort.

Banks may enter into derivative contracts to sell protection to counterparties seeking to hedge their or take speculative positions in credit risk. Also known as Off-Balance sheet items Off-Balance sheet assets or liabilities and Incognito Leverage. Off balance sheet items a concern for private banks Premium 1 min read. That you foresee and provide additional. The off-balance sheet exposures in banking activities refers to activities that do not involve loans and deposits but generate fee income to the banks. Another key part of off-balance sheet items for financial companies is in its role in calculating leverage ratios which are required by Basel IIIspecifically the SLR or supplementary leverage ratio. Off balance sheet items are anticipatory items. What are off-balance-sheet items and why are they important to some financial firms. They sometimes use derivatives to hedge their risks. The cash you paid is reduced from the Cash in hand from the Asset section.

What are off-balance-sheet items and why are they important to some financial firms. Financial innovation involves more than development and diversification of new borrowing sources. The off-balance sheet elements of banks are commitments of banks that do not imply initial outlays of cash. Sheet activities was a natural outgrowth of banks providing such risk management services. The off-balance sheet exposures in banking activities refers to activities that do not involve loans and deposits but generate fee income to the banks. Off balance sheet items are anticipatory items. Also known as Off-Balance sheet items Off-Balance sheet assets or liabilities and Incognito Leverage. During the past couple of decades financial institutions have sharply expanded their off-balance sheet activities. Since the 1980s off-balance sheet commitments have grown rapidly in major banks among which there are swaps forward rate agreements bankers acceptances revolving underwriting facilities etc. The amount of goods will come in Current assets in the Asset section of your balance sheet.

Both are triggered by default of direct obligor resulting in credit exposure to guarantor whether it is. Those commitments give rise to new types of credit risk from the possibility of default by the counter party. In general the OBS items appear. The cash you paid is reduced from the Cash in hand from the Asset section. Sheet activities was a natural outgrowth of banks providing such risk management services. The off-balance sheet exposures in banking activities refers to activities that do not involve loans and deposits but generate fee income to the banks. The third major category of banks off-balance sheet items reported in the Enhanced Financial Accounts is derivatives. They sometimes use derivatives to hedge their risks. The growth of off-balance. During the past couple of decades financial institutions have sharply expanded their off-balance sheet activities.

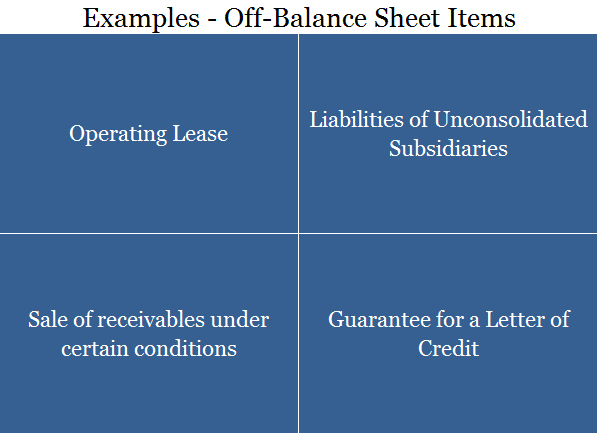

The use of off-balance sheet may improve activities earnings ratios because earnings generated from the. They are either a liability or an asset which are not shown on a companys balance sheet as the business is not a legal owner of the respective item. Off balance sheet items a concern for private banks Premium 1 min read. It also affects the entire range of financial. Off-balance sheet OBS items is a term for assets or liabilities that do not appear on a companys balance sheet. Since the 1980s off-balance sheet commitments have grown rapidly in major banks among which there are swaps forward rate agreements bankers acceptances revolving underwriting facilities etc. Off-balance sheet OBS refers to assets or liabilities that do not appear on a companys balance sheet. Although not recorded on the balance sheet they are still assets and liabilities. That is they try to earn income should the banks main business suffer a decline if say interest rates rise. The growth of off-balance.