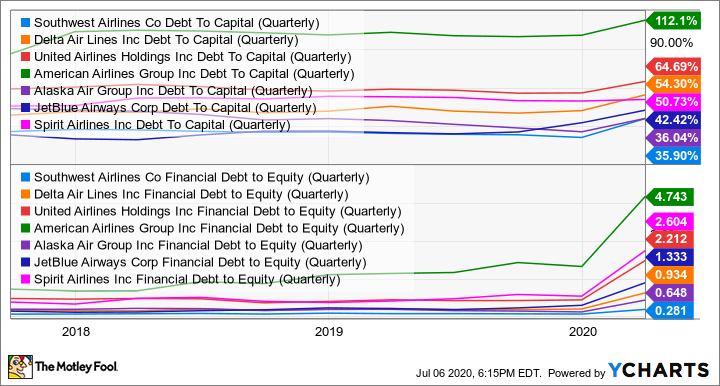

Debt to Asset Ratio-128. Its superior balance sheet is of paramount importance as it gives the company resilience during downturns. Below we presented the list of 5 best best airline stocks to buy for. Debt to Asset Ratio-063. Airline stocks given consistent growth a clean balance sheet a young fleet and reasonable valuation. Cash To Zero at Current Burn-1121. Jet blue has only 484m in net debt whereas Delta has 901B while American Airlines has 197B and Southwest has 154B. Thanks to its strong balance sheet Southwest enjoys by far the greatest rating from the three major credit rating firms in its peer group. Cash to Zero at Current Burn-421. This helps explain its above mentioned consistency which is unique in its sector.

To that end weve put together a list of stocks with fortress balance sheets --a term popularized by JP Morgans Jamie Dimon. Specifically we asked our analysts to provide two picks from. Debt to Asset Ratio-128. Cash to Zero at Current Burn-421. Southwest has the industrys best balance sheet and is an investor favorite for its ability to survive regardless of the challenges that come its way. Cash To Zero at Current Burn-1121. The chart below shows that at the end of 4Q16 American Airlines AAL had the highest leverage ratio of 114x. If playback doesnt begin shortly try restarting your device. Delta looks good as. Below we presented the list of 5 best best airline stocks to buy for.

Q2 Cash Burn-100MDay slowing to 50MDay. Airline stocks given consistent growth a clean balance sheet a young fleet and reasonable valuation. To that end weve put together a list of stocks with fortress balance sheets --a term popularized by JP Morgans Jamie Dimon. Southwest is my preferred choice out of the 4 major US. Airline Balance Sheets - Part 2 - YouTube. AAL is followed by United Continental UAL with. Delta looks good as. Debt to Asset Ratio-063. Cash to Zero at Current Burn-421. Thanks to its strong balance sheet Southwest enjoys by far the greatest rating from the three major credit rating firms in its peer group.

Airline Balance Sheets - Part 2 - YouTube. Jet blue has only 484m in net debt whereas Delta has 901B while American Airlines has 197B and Southwest has 154B. Below we presented the list of 5 best best airline stocks to buy for. If youre looking for gains in airline stocks stick with high-quality companies such as Delta and United and avoid those with vulnerable balance sheets and operationsnamely American and Spirit. Also jetblue has the second highest PE ratio in right now out of these 4. Airline stocks given consistent growth a clean balance sheet a young fleet and reasonable valuation. Southwest has the industrys best balance sheet and is an investor favorite for its ability to survive regardless of the challenges that come its way. Ad Find Best Sheets. Its superior balance sheet is of paramount importance as it gives the company resilience during downturns. Debt to Asset Ratio-063.

If youre looking for gains in airline stocks stick with high-quality companies such as Delta and United and avoid those with vulnerable balance sheets and operationsnamely American and Spirit. Debt to Asset Ratio-128. Airline Balance Sheets - Part 2 - YouTube. Thanks to its strong balance sheet Southwest enjoys by far the greatest rating from the three major credit rating firms in its peer group. Cash To Zero at Current Burn-1121. Southwest is my preferred choice out of the 4 major US. AAL is followed by United Continental UAL with. Q2 Cash Burn-100MDay slowing to 50MDay. Jet blue has only 484m in net debt whereas Delta has 901B while American Airlines has 197B and Southwest has 154B. Airline stocks given consistent growth a clean balance sheet a young fleet and reasonable valuation.