The purpose of retaining these earnings can be varied and includes buying new equipment and machines spending on research and development or other activities that could potentially generate growth for. As the company becomes profitable the roll-forward of corporate profits will increase the retained earnings balance and bring it. In this case the retained earnings account will show a negative number on the balance sheet. When earnings are retained rather than paid out as dividends they need to be accounted for on the balance sheet. It does not have any money in retained earnings so it cannot pay out a dividend. If a company just started operating this number will equal to zero. This negative or positive amount of retained earnings is reported as a separate line within stockholders equity. If the entity operation generates net income then retained earnings are positive and if the entity makes operating losses then retained earnings will turn negative. Warren Buffet recommended creating at least 1 in market value. This will be your beginning retained earnings.

Retained Earnings This account is used to track all profits for prior years minus any distributions or. Since retained earnings are part of shareholders equity continuous significant losses can decrease retained earnings to the point that their negative balance brings the total stock value down. The owners drawing account in a sole proprietorship will have a debit balance. Negative retained earnings are a component of the Statement of Shareholders Equity on a balance sheet. So as others have already stated negative retained earnings is typically the result of losses exceeding profits. If a company operates at a net loss the net losses will result in a negative retained earnings account on the balance sheet. Retained earnings represent the cumulative net income of a company. Youll find the retained earnings listed under shareholders equity also called stockholders equity. This negative or positive amount of retained earnings is reported as a separate line within stockholders equity. Retained earnings can be negative if the company experienced a loss.

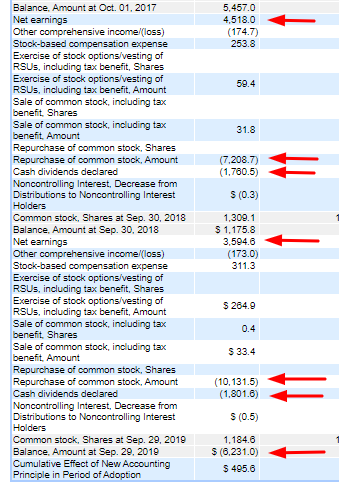

A company with negative retained earnings is said to have a deficit. Retained earnings can be negative if the company experienced a loss. It does not have any money in retained earnings so it cannot pay out a dividend. Negative retained earnings appear as a debit balance in the retained earnings account rather than the credit balance that normally appears for a profitable company. When earnings are retained rather than paid out as dividends they need to be accounted for on the balance sheet. The negative retained earnings are mainly because of consistent losses from its operations especially due to slowdown in its Chinese market. As you see in the above snapshot there is a huge amount of negative retained earnings accumulated deficit in the Revlon balance sheet which is leading to negative total equity. First you take retained earnings from the Balance Sheet of a previous reporting year. Retained earnings represent a useful link between the income statement and the balance sheet as they are recorded under shareholders equity which connects the two statements. When stockholders equity is negative it is not noted as such on the balance sheet.

Youll find the retained earnings listed under shareholders equity also called stockholders equity. Negative retained earnings are a component of the Statement of Shareholders Equity on a balance sheet. First you take retained earnings from the Balance Sheet of a previous reporting year. Hence if it is reported as a separate line it is reported as a negative amount since the owners equity section of the balance sheet normally has credit balances. As you see in the above snapshot there is a huge amount of negative retained earnings accumulated deficit in the Revlon balance sheet which is leading to negative total equity. This will be your beginning retained earnings. When earnings are retained rather than paid out as dividends they need to be accounted for on the balance sheet. Negative retained earnings are a common occurrence for startups and unprofitable companies. This negative or positive amount of retained earnings is reported as a separate line within stockholders equity. Warren Buffet recommended creating at least 1 in market value.

Retained earnings represent the cumulative net income of a company. Warren Buffet recommended creating at least 1 in market value. Retained earnings represent a useful link between the income statement and the balance sheet as they are recorded under shareholders equity which connects the two statements. Retained earnings are the balance sheet items that record under equity sections. Since retained earnings are part of shareholders equity continuous significant losses can decrease retained earnings to the point that their negative balance brings the total stock value down. Retained earnings can be negative if the company experienced a loss. This will be your beginning retained earnings. If the entity operation generates net income then retained earnings are positive and if the entity makes operating losses then retained earnings will turn negative. The owners drawing account in a sole proprietorship will have a debit balance. This negative or positive amount of retained earnings is reported as a separate line within stockholders equity.