Access your income statement through ATO online services via myGov. Log in to your myGov account. Open MyGovCodeGenerator app on your mobile phone iOS Android. For some reason somehow through STP 2 income statements for each employee have been recorded with the ATO same company so when our employees login to the ATO online or MyGov they can all see 2 statements. Select from the top of the screen Employment and then Income statements. Using your income statement for your tax return. Your income statement will show your year-to-date. My employer told me to get an Income Statement from the ATOs MyGov website I didnt get a PAYG this year A lot of people are confused about Income Statements. Select Documents and Appointments followed by Documents and Request a document. I have completed the end of year finalisation and the.

Using Reckon Accounts Hosted. Select from the top of the screen Employment and then Income statements. Employees need to login to the myGov portal to download their income statement for the tax period. Ad Find Income Statement Form. Sign in to myGov with your username and password. Employees can access year-to-date and end-of-year income statement online through myGov or talk to their registered tax agent. Select Income Statement from the. Select the Australian Taxation Office from Services 3. How do I access my income statement. Youll need to send it to applyjfl.

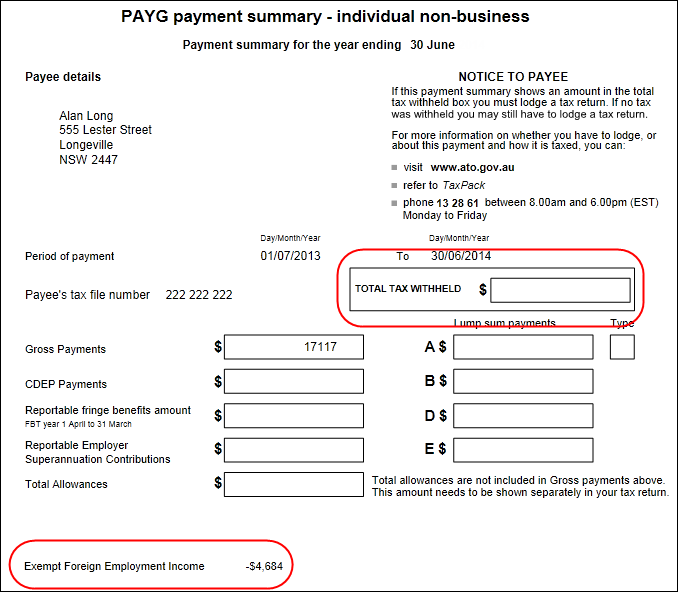

Income Statements show an employees year-to-date salary and wages the tax that has been withheld and the superannuation that has been paid. Youll need to send it to applyjfl. Access your income statement through ATO online services via myGov. My employer told me to get an Income Statement from the ATOs MyGov website I didnt get a PAYG this year A lot of people are confused about Income Statements. Employees can access year-to-date and end-of-year income statement online through myGov or talk to their registered tax agent. Lets clear it up quick. The income statement was introduced as part of the Single Touch Payroll initiative that the ATO introduced in the 2018-2019 tax year. Employees income statement not showing the correct STP figures. Select the Australian Taxation Office from Services 3. Click on Employment at the top of the screen.

To use your Centrelink online account you need to sign in through myGov. First of all login into my go. I have tryed removing the finalisation and then re finalising them but this has had no effectI am also getting this message back from the ATO. If your employer is reporting through STP you will receive an income statement. Sign in to myGov with your username and password. How to access your income statement. Detailed Income and Asset Statement. Using Reckon Accounts Hosted. Select Income Statement from the. Theyre all names for the same thing and the name used now is.

Using your myGov account go to mygovauhelp. I have 1 employee in which their income statement via MyGov is not showing the correct amounts and is also stating Not tax ready. I have completed the end of year finalisation and the. For some reason somehow through STP 2 income statements for each employee have been recorded with the ATO same company so when our employees login to the ATO online or MyGov they can all see 2 statements. Open MyGovCodeGenerator app on your mobile phone iOS Android. Employees can access year-to-date and end-of-year income statement online through myGov or talk to their registered tax agent. If you werent able to add your Centrelink detailed Income and Asset Statement to your application heres how to get it. I have tryed removing the finalisation and then re finalising them but this has had no effectI am also getting this message back from the ATO. Tax that has been withheld. Employees need to login to the myGov portal to download their income statement for the tax period.